nj tax sale certificate premium

Lands listed for sale. Tax Sale Procedure How does it work Purchasing a tax sale certificate is a form of investment.

Customer Reviews Gold Icon Customer Review Icon Design Icon

As with any governmental activity involving property rights the process is not simple.

. This is your permit to collect Sales Tax and to use Sales Tax exemption certificates. This legislation establishes requirements for publication of notice issuance of notice to the property owner bidder registration conducting the online tax lien sale as. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

The tax lien is then put up for auction and the winning bidder receives a tax sale certificate enabling it to foreclose within two years if the certificate is not redeemed. This certificate provides authorization from the State of New Jersey to. If the tax sale certificate is not redeemed or the property foreclosed upon within the five year period then the premium escheats to the municipality.

To 430 pm Monday through Friday excluding State holidays. Completed New Jersey Resale Certificate Form ST-3 or Streamlined Sales and Use Tax Agreement Certificate of Exemption Form ST-SST. Taxations Field Investigations Unit.

Dates of sales vary depending on the municipality. The Excise Tax is based on the number of cartons purchased regardless of the price paid. Complete in Just 3 Steps.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is. Out-of-State Sales New Jersey Sales Tax Publication ANJ-10 Introduction In general Sales Tax is due to the state where the purchaser takes possession or delivery of the items. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business.

The Plaintiff in a tax sale foreclosure must at least 30 days prior to filing its complaint give written notice of its intention to foreclose as well as the amount necessary to redeem. Fast Easy and Secure Online Filing. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate.

The purchaser must complete all fields on the exemption certificate in order to claim the exemption. Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600. If you bid premium and most liens in New Jersey are won at high premiums you dont get any interest on the certificate amount however you do get interest on the subsequent tax payments.

Installments not yet due may be excluded. Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services.

Its hours are 830 am. Once a tax clearance is approved we send the certificate electronically to the municipal clerk where the license is located. The municipality has to give you back your premium of 1000000.

Interest accrues on a tax sale certificate at the rater of 2 per month or a maximum of 24 interest per year counting each fraction of a month as an entire month from the month of purchase Title X Section 4471. Receive your application in 5 business days or less if you choose to expedite. Real Estate and Tax Law.

Ad Apply For Your Resellers Permit. A New Jersey resident who purchases unstamped cigarettes from the internet phone or mail is responsible for the tax. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

Ad Provide your business with the necessary permits to be successful. Up to 25 cash back Again in a New Jersey tax sale the property is sold at a public auction subject to the right of redemption to the person who offers the lowest interest rate on the tax debt which cant exceed 18. The ClearanceLicense Verification Unit works with the.

Taxations Audit branch to administer the Liquor License Clearance program. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. Interest on subs is 8 per annum until 1500 is owed then its 18.

In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. The premium is kept on deposit with the municipality for up to five years. Statement in certificate of sale.

List of installments not due. Here is a summary of information for tax sales in New Jersey. If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you.

New Jersey is a good state for tax lien certificate sales. Bidding stops to obtain the tax sale certificate. If the tax sale certificate is not redeemed or the.

Discretion of tax collector as to sale. To accept a New Jersey Resale Certificate the supplier must be registered with the State. Delinquency on a property may accrue interest at up to 8 for the first 150000 due and 18 for any amount over 150000 If the delinquency exceeds 1000000 at the end of a municipalities fiscal year there may be an addition 6 penalty.

The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. If you need help completing the Business Registration Application Form NJ-REG or have any registration questions call the Division of Revenue and Enterprise Services Business Registration Services Office at 609-292-9292 Option 1. How was this tax determined.

18 or more depending on penalties. A New Jersey Certificate of Authority Form CA-1 for Sales Tax is sent to the business. The description below is designed to provide the reader with a brief overview of this procedure.

But if at the sale a person offers a rate of interest less than 1 or at no interest that person may instead of an interest rate offer a premium over the tax amount. New Jersey Tax Lien Auctions. Sales and Use Tax is assessed at 6625 of the cigarette sales price.

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. State Alcohol Beverage Commission. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders.

Skip the Lines Apply Online Today. Contracts considered professional service.

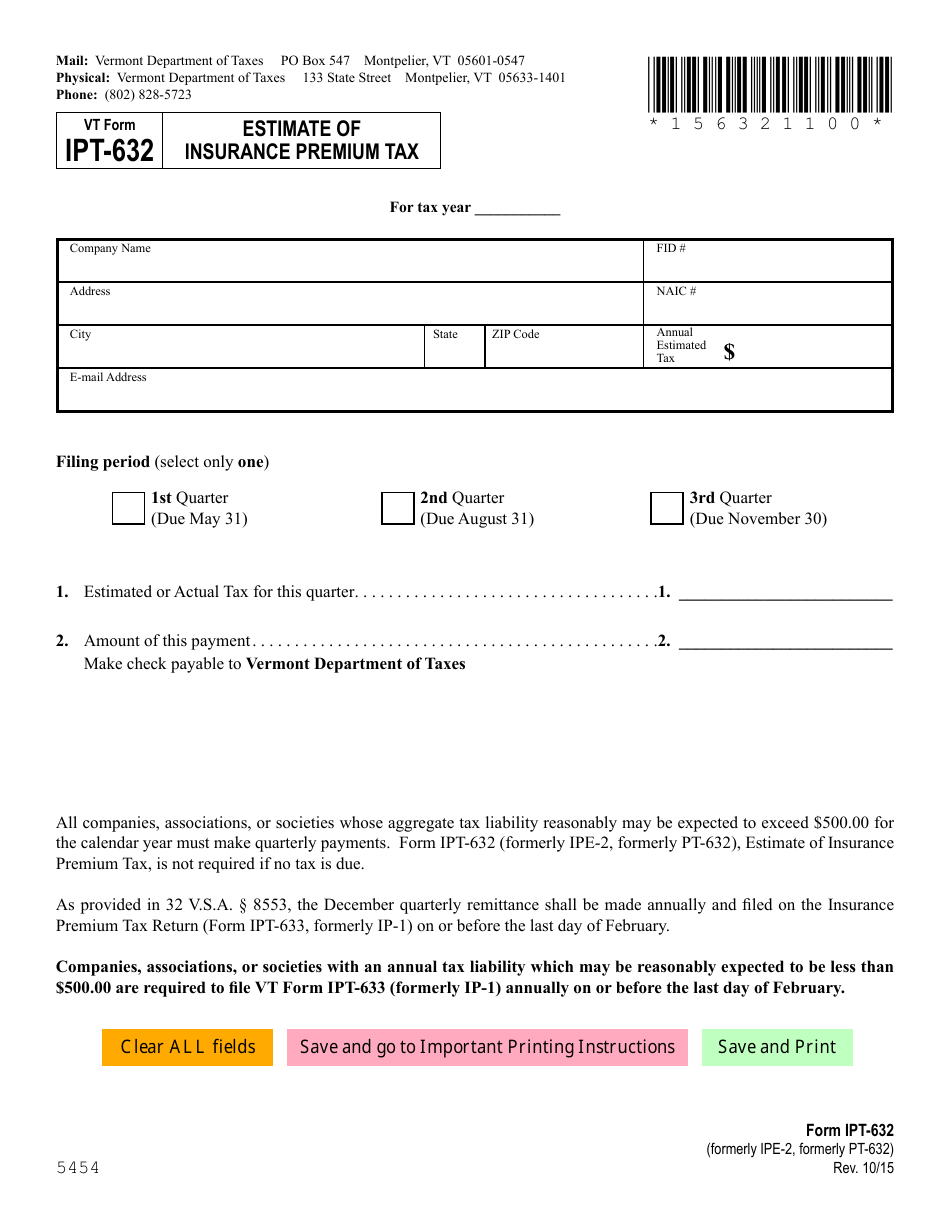

Vt Form Ipt 632 Download Fillable Pdf Or Fill Online Estimate Of Insurance Premium Tax Formerly Ipe 2 Formerly Pt 632 Vermont Templateroller

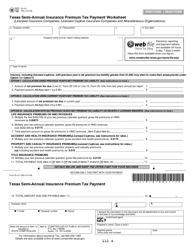

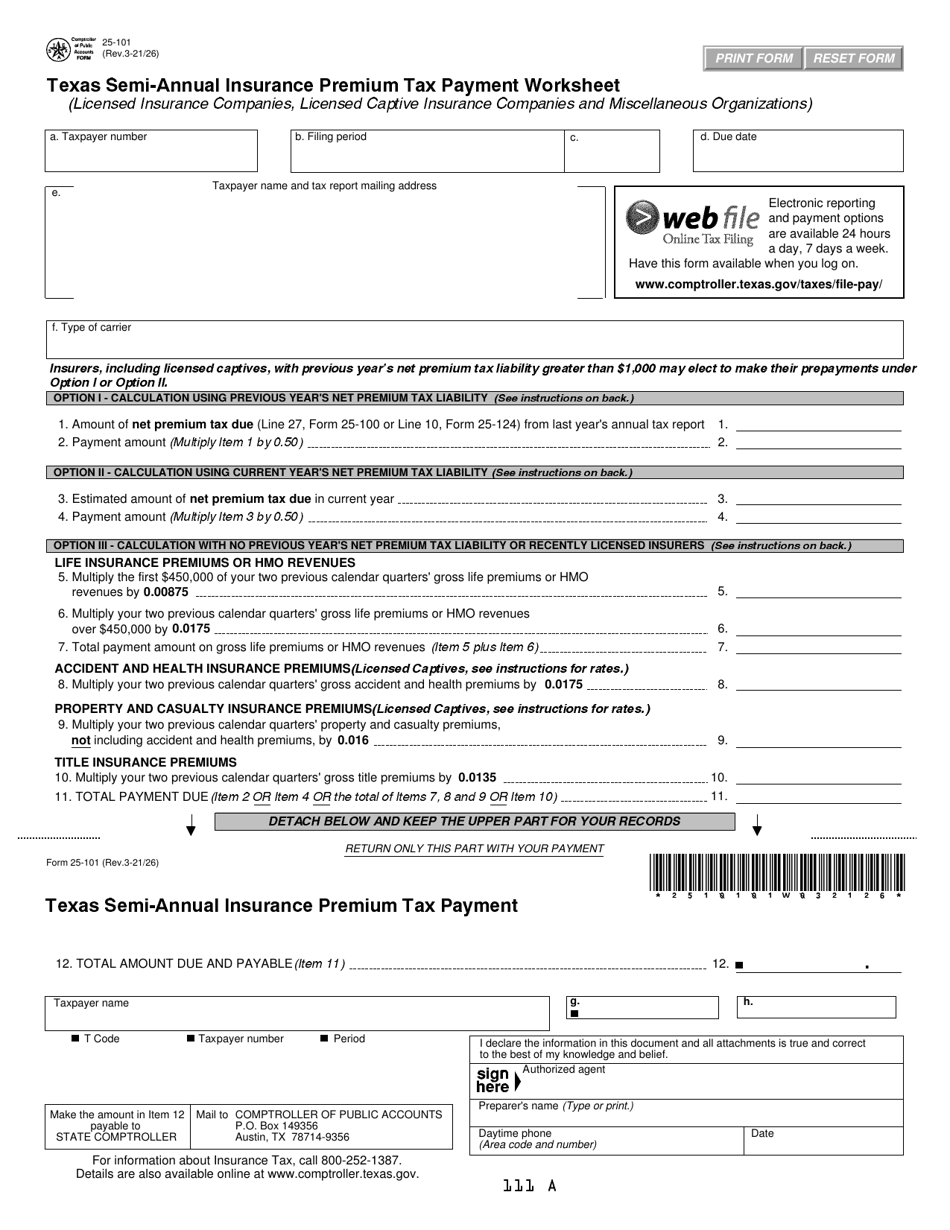

Form 25 101 Download Fillable Pdf Or Fill Online Texas Semi Annual Insurance Premium Tax Payment Worksheet Texas Templateroller

Premium 2bhk At Price Of 1bhk Peaceful Life One Life Blue Water

How To Buy Bank Owned Property 6 Great Tips Buying Investment Property Real Estate Investor Foreclosed Properties

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

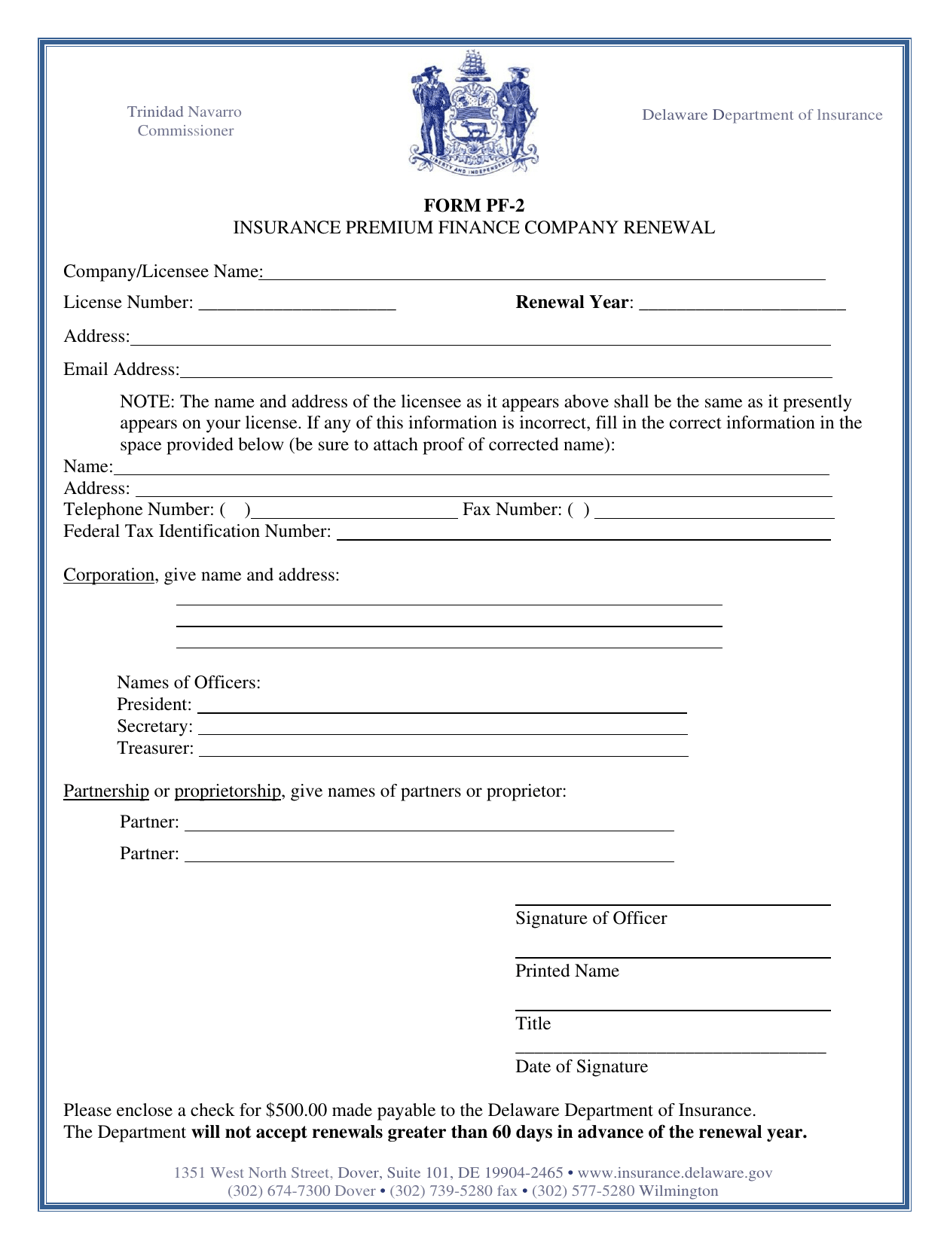

Form Pf 2 Download Fillable Pdf Or Fill Online Insurance Premium Finance Company Renewal Delaware Templateroller

Renewal Of Registration Certificate For Your Vehicle Road Tax Learn Drive Vehicles

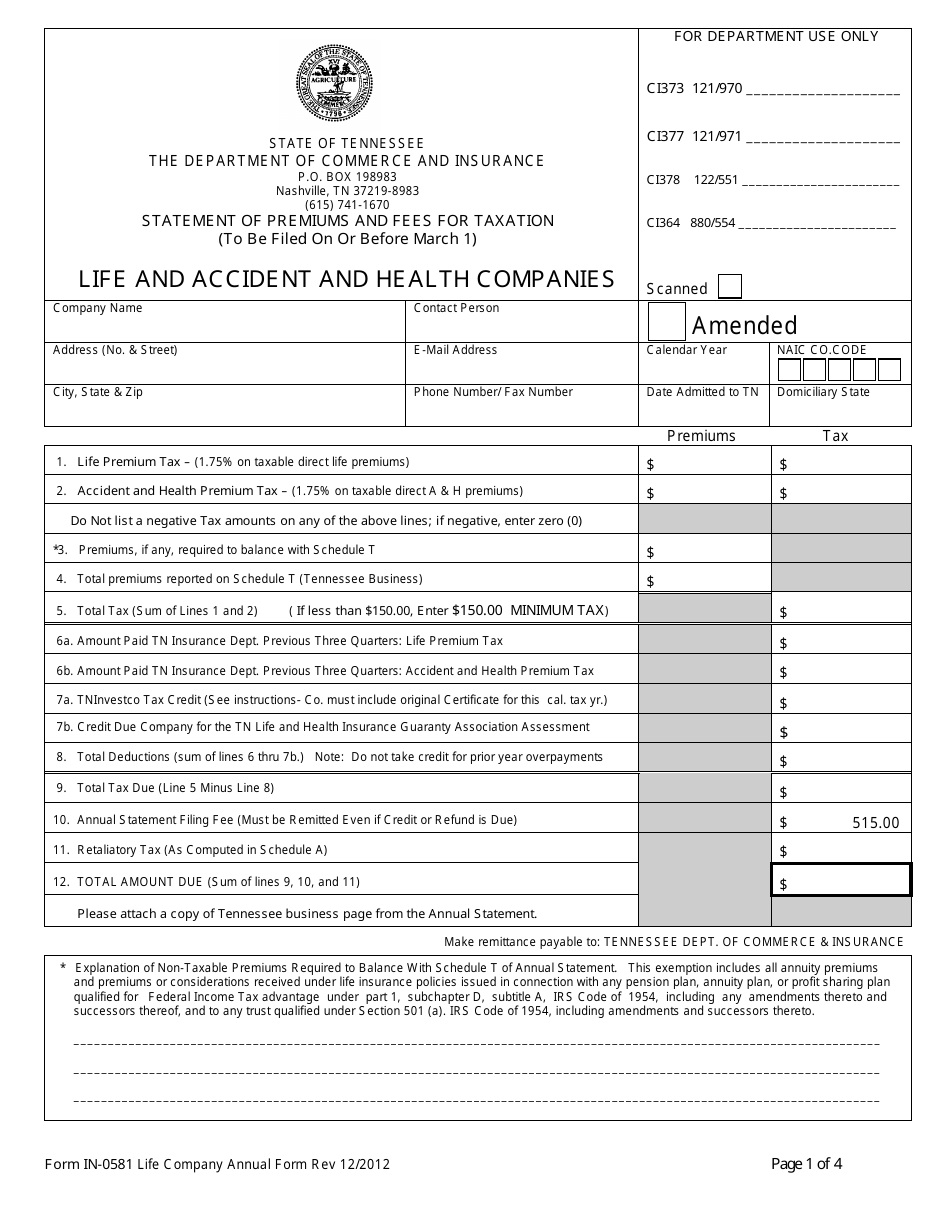

Form In 0581 Download Printable Pdf Or Fill Online Statement Of Premiums And Fees For Taxation Life And Accident And Health Companies Tennessee Templateroller

Are You Bidding Premium For Tax Liens Tax Lien Investing Tips

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

Furniture Bill Of Sale How To Create A Furniture Bill Of Sale Download This Furniture Bill Of Sale Bill Of Sale Template Bill Of Sale Car Business Template

Form 25 101 Download Fillable Pdf Or Fill Online Texas Semi Annual Insurance Premium Tax Payment Worksheet Texas Templateroller

Windows 7 Home Premium Sp1 32bit Oem System Builder Dvd 1 Pack For Refurbished Pc Installation Recomended Microsoft Software Microsoft Windows Microsoft

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense